What is “FABCO”?

We annually conduct our proprietary survey method, “FABCO (Futaba’s Assessment of Brands & Consumer)”.

The survey covers fresh trend information and analysis in the market, exploring what is happening to brands, media, and consumers, and the interrelationship among them from various aspects.

FABCO data and examples of use

- Brand awareness rate, purchase rate, purchase intention rate

- Brand user profile

- Media touchpoint analysis by age and gender group (Social media / Digital / Magazines)

- Shopping facilities user analysis

- Consumers fashion insights

FABCO2022 Survey overview

-

Subjects

Tokyo/Osaka

areas

20-59y/o

Women/Men -

Samples

10,082

Women 6,186 Men 3,896 -

Brands

380

Women 220 Men 160 - Survey period

- 2022 August 5th – August 9th

- Survey method

- Internet monitor survey

- Survey planning

- Futaba Tsushinsha Co., Ltd.

- Operation

- MACROMILL, INC.

FABCO2022 Summary

In 2022, we welcomed the first summer in three years with no action restrictions, despite the continuing negative news such as the rapid depreciation of the yen due to the worsening global situation and the rush to raise prices due to the high cost of living.

Real events have also returned, and people’s motivation and actions are now directed to the outside world.After the Corona Disaster, there was a change in contact with fashion information and fashion awareness.

Women’s purchase of fashion items at physical stores increased

- Increased purchases at station buildings/fashion buildings/brand-owned stores/shopping malls

Recognition of luxury brands increased for both men and women. Domestic brands also grew among women.

- The growth in both men and women was noted for pop-ups and collaborations. (LOEWE/MARNI/THE NORTH FACE)

Fashion consciousness is becoming more “sustainable. People are now choosing expensive but long-lasting items and taking good care of them.

- What suits you/standards that never go out of style/long-lasting use > Trends

- Women tend to seek value-added items

Fashion style “neat clothes” is the current mood.

- In addition to the increase in opportunities to go out, both men and women are seeking “neat fashion,” perhaps as a reaction to the home fashion of the nestling period.

- “Casual and easy to move” is not enough for women to make purchases.

Power of “storefronts” and “people” as contact points for fashion information slowed slightly, while “events/pop-ups” accelerated.

- The importance of storefronts has decreased, perhaps because people have become accustomed to obtaining fashion information from sources other than actual stores due to the Corona Disaster. Need to increase the value of information and experiences obtained in stores.

- It is becoming difficult to be interested in a brand or product simply because “a fashionable person wears it. The meaning of what the person wears may also be important.

- Greatly interested in events and pop-ups where they can directly feel the brand’s message and momentum, and actively visit them.

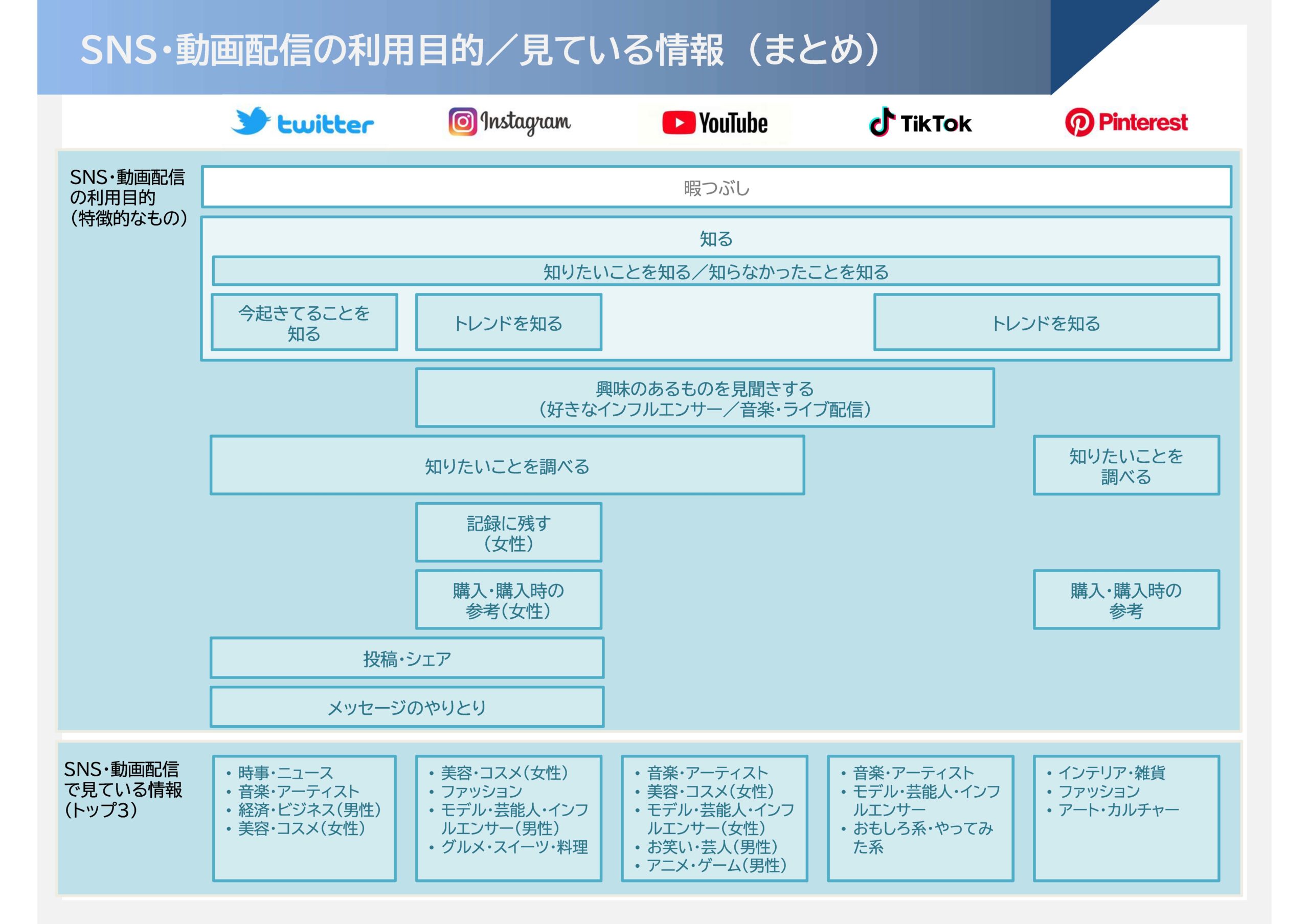

Purpose of using SNS & video distribution = “to kill time” + “to know what I want to know/what I don’t know”.

- The use of social networking to get the word out about something is important. Different funnels have different effective platforms.

Pinterest×Fashion = Compatibility♡

- Pinterest’s user base still has room to grow, and the rate of checking fashion information on Pinterest is high, approaching that of Instagram