What is “FABCO”?

The data is from Futaba Tsushinsha’s original internet survey,

focusing on ’fashion’, ‘media’ and ‘consumers’.

*Conducted once a year for each of the fashion and jewelry sections

FABCO data and examples of use

- Brand awareness rate, purchase rate, purchase intention rate

- Brand user profile

- Media touchpoint analysis by age and gender group (Social media / Digital / Magazines)

- Shopping facilities user analysis

- Consumers fashion insights

Please contact us for details.

FABCO 2024 Survey overview

-

Subjects

Tokyo/Osaka

areas

20-59y/o

Women/Men -

Samples

9,757

Women6,075 Men3,682 -

Brands

380

Women220 Men160 -

Major magazine

Approx.130magazine

total for both sexes -

Main SNS/Digital Media

Approx.200media

total for both sexes -

Main commercial premises

Approx.70facilities

Tokyo metoropolitan area and Keihanshin - Survey period

- 2024 August 2nd-August 5th

- Survey method

- Internet monitor survey

- Survey planning

- Futaba Tsushinsha Co.,Ltd.

- Operation

- Macromill Corporation

*Survey target is men and women living in the Tokyo metropolitan area (Tokyo, Kanagawa, Saitama, Chiba) and Keihanshin (Osaka, Kyoto, Hyogo) with an annual fashion consumption of 50,000 yen or more

*Questions about the brand were divided into 2 groups of men and 3 groups of women.

*Research results are tabulated based on the number of samples after weighting back

FABCO 2024 Survey Summary

The “interest in things” that had died down between 2010 and 2011 has made a come back.

However, the continuing high cost of living is affecting fashion consumption.

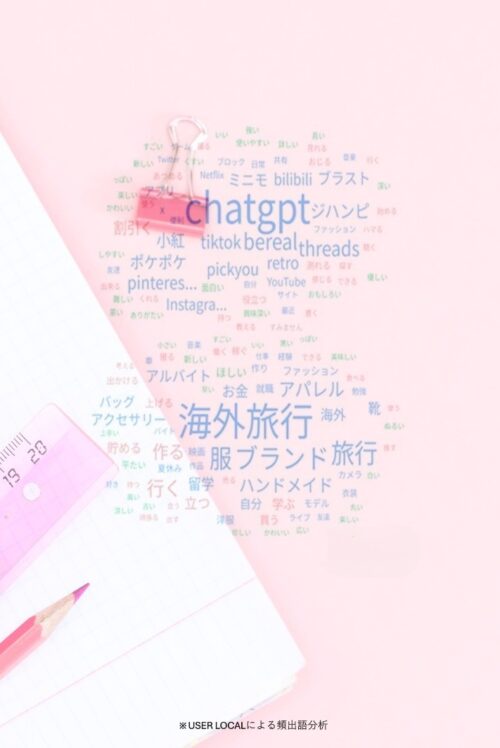

The presence and influence of “SNS” as a source of information is increasing.

-

【Fashion Consumption Trends】

- Reflects the rise in unit purchase prices due to wage increases linked to rising prices, hourly wage increases, and price increases.

- The top choice for both men and women was “online shopping”

- There was a slight decrease in the use of almost all purchasing locations, whether online or in real stores.

- Brands that saw growth in both recognition rate and purchase intention rate:Male「Maison Margiela」, Female 「AMI PARIS」「lululemon」

- Brands whose recognition rate increased for both men and women:「Maison Margiela」「AMI PARIS」「THE ROW」

- Against the backdrop of rising prices, both men and women have shifted from a focus on quality to a focus on price and on making no mistakes when shopping.

- Men want to find something that suits them and makes them look good, in a safe way. For women, the focus on eyewear as a fashion point is increasing, and the limited nature of “only here, only now” trends to push them forward.

- The top source of fashion information for both men and women is the Internet, but only SNS is at the same level as last year or has increased from last year.

- For women, “SNS” has overtaken “in-store” to become the second most popular source of information.

- Men are increasingly less likely to actively seek out fashion information.

- Men are also increasing their use of Instagram, and their use of social networking services is growing. On the other hand, they are selecting different services for video and music streaming.

- The rate of contact with social networking services, subscription video and music distribution services in general is increasing among women. The number of platforms used by each person is increasing.

- For both men and women, the negative score for “I want to know about things that are being talked about in the world” has continued from last year.

- As the use of SNS and videos increases, the weight of “comparing and considering” information and products of interest based on algorithms, rather than following vague world trends, will increase.

- There is almost no difference in the number of department stores by age.

- Younger generations (in their 20s and 30s) use “variety stores” and “cosmetics select shops” that stock trendy products, as well as “discount stores” where you can shop for cheap.

- The highly reliable “official online shopping site of the brand” is used by people in the older age group (40s-50s).

- The older the generation, the more likely they are to buy “in-store”. The 40-50 age group will input real-world cosmetic information “in-store”, and then casually purchase from the “official website of the brand” they trust.

- “People” are also an important source of information for people in their 20s. For people in their 20s, influence from both “people” and “stores” is about the same.

- Young people “love budget-friendly, Korean, and new cosmetics”. They change their image and switch their moods by changing their makeup, hair, and nails. Fragrances are a familiar item that they use themselves and also use as gifts. Live broadcasts and the endorsement of beauty professionals are likely to lead to purchases.

- A beauty consciousness that is not dependent on brands, such as “I’ll buy it even if it’s expensive as long as it works”, “I value ingredients”, “sun protection”, and “eating for beautiful skin”, is spreading among people of all ages.

Both men and women saw an increase in household income and fashion purchases

Despite an increase in the amount of money spent on fashion, the number of stores visited has decreased slightly

The factors that contribute to brand recognition and purchase intention are “collaboration”, “increased exposure through perfume and miscellaneous goods”, “links with Korean trends”, and “local ambassadors”

Both men and women are becoming more price-conscious. Men are becoming “fashion lost” as they are conscious of what other people think. Women are searching for “where to spend money” and “deciding on fashion”

-

【Communication Trends】

The influence of “SNS” as a source of fashion information is increasing. It is becoming a source of information that surpasses “stores”

The contact rate for both men and women for “TikTok” and “Tver” has increased significantly.

Women are more proactive when it comes to information. “My own interests” rather than “new topics”, “Comparative study”

-

【Beauty Trends (By Age of Women)】