What is “FABCO”?

This is an original online survey conducted by FUTABA TSUSHINSHA CO.,LTD. focusing on fashion, media, and consumers.

*Fashion Edition / Jewelry Edition: conducted once per year each

FABCO 2025 Survey Overview

-

Samples

Men & women

Approx.10,000respondents

Tokyo metropolitan area

&

Keihanshin area

Ages 20–50

-

Brands

Approx.400brands

men & women, cumulative

Apparel and fashion accessories -

Major SNS/Digital Media

Approx.200media

men & women, cumulative -

Major Magazines

Approx.130titles

men & women, cumulative -

Major commercial facilities

Approx.70locations

Tokyo metropolitan area

&

Keihanshin area - Survey period

- 2025 August 1st-August 11th

- Survey method

- Internet monitor survey

- Survey planning

- Futaba Tsushinsha Co.,Ltd.

- Operation

- Macromill Corporation

*Survey target is men and women living in the Tokyo metropolitan area (Tokyo, Kanagawa, Saitama, Chiba) and Keihanshin (Osaka, Kyoto, Hyogo) with an annual fashion consumption of 50,000 yen or more.

*Valid responses: 9,855 samples ( Men 3,732ss Women 6,123ss).

*Weighted aggregation was applied to the collected samples to match the gender and age population composition based on the 2020 Population Census conducted by the Statistics Bureau of Japan.

*All research results are tabulated using the weighted sample counts.

*Brand-related questions were asked by dividing respondents into two men’s groups and three women’s groups.

*Sample size per group: Men 1,866ss per group / Women 2,041ss per group.

*Question items: Brand awareness / Purchase experience / Purchase intention for each brand.

Key Survey Items – FABCO Fashion Edition

- 【Basic Demographics】

- Gender / Age / Region of residence / Occupation / Marital status / Presence of children / Household income / Personal income

- 【Fashion】

- Annual fashion purchase expenditure

- Purchase channels

- Sources of fashion information

- Influencers・people whose posts attract attention

- Brand perception (awareness, purchase experience, purchase intention)

- Fashion attitudes

- Key decision factors when purchasing clothing, bags, and shoes

- 【Media】

- Media exposure by vehicle type: Social media/Video platforms / Websites / Magazines / Newspapers

- 【Consumers】

- Cities / areas frequently visited for leisure

- Commercial facilities used

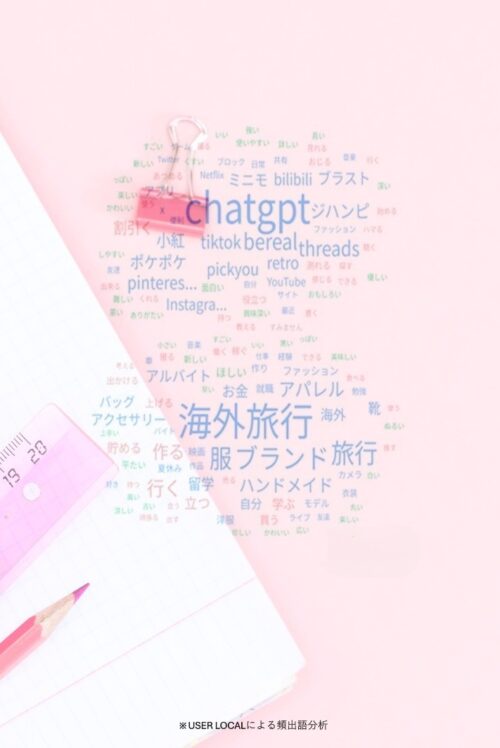

- Areas of interest

- Information-seeking attitude / SNS attitude

- Purchasing attitudes

- Attitudes toward food, living, and art

- Purchase locations and information sources for skincare, makeup, and haircare products

- Beauty consciousness / beauty attitudes

Recommended Use Cases~FABCO can be effectively utilized in the following situations~

- When you want to understand brand perception(brand awareness, purchase experience, and purchase intention)

- When you want to identify and analyze brand user personas

- When you want to understand attitudes, purchasing behavior, and media exposure by gender and age group, or among people who meet specific criteria

Please contact us for details.

FABCO 2025 Summary

Consumer Insights from FABCO 2025

- Prolonged inflation and rising prices are impacting fashion consumption.

- Consumer preferences are shifting from a post-COVID focus on “quality and premium orientation” to a stronger emphasis on cost performance and practicality.

- At the same time, consumers are not driven by frugality alone; trends such as selective spending and valuing excitement and emotional uplift are also evident.

- Compared with social approval or fashion trends, consumers place greater importance on their own preferences, convenience, and personal resonance.

- The influence of SNS and user-generated content (UGC) continues to grow.

- 【Fashion Consumption Trends】

Trends in Purchasing Power: Rising incomes in line with continued inflation and higher unit prices due to price increases are influencing purchasing power

- Men:Even as household income increases, fashion spending shows a slight decline, indicating a tightening of spending behavior.

- Women:Both household income and fashion spending are increasing, with no clear signs of direct spending restraint.

Fashion Purchase Channels:Reduced channel switching and a decline in “preference-driven, high–unit-price channels”

- For both men and women, EC (e-commerce) remains the core channel, but most channels declined year over year.

- The number of channels used per person is decreasing, with consumers narrowing their channel choices and adopting a more efficiency-oriented purchasing behavior.

- Department stores declined for both genders. Preference-driven, high–unit-price channels such as brand-owned stores and select shops also showed negative trends.

Brand Perception: Growth in Casual & Sports Brands. Substantive product development, collaborations, and experiential initiatives are contributing to growth.

- Top brands showing growth in both awareness and purchase intention

Me:「SALOMON」「ARC’TERYX」「mont-bell」

➣Premium sports and outdoor brands that balance functionality and design, as well as business bag and footwear brands, are gaining traction.

Women:「coca」「FEILER」「ONITSUKA TIGER」

➣Growth is seen in city casual, sports-mix, and denim brands primarily sold through shopping centers and EC. Accessories and footwear that combine affordable pricing with a contemporary feel are particularly well received.

Fashion Attitudes

- Among both men and women, there is a clear shift away from dressing for others’ perceptions or trends, toward a stronger focus on personal preferences, emotional resonance, and budget considerations.

- Men:Fashion attitudes are becoming polarized between “casual / cost-performance–oriented” and “neat / quality-oriented” segments.

➣While versatility and mix-and-match capability are valued, interest in costly indulgences or trend-following driven by social visibility is gradually weakening. - Women:The influence of Instagram on fashion choices is strengthening.

➣Touchpoints are increasing, including out-of-home (OOH) media.

➣Women enjoy switching styles by TPO (time, place, occasion), and more than 50% embrace genderless fashion choices, indicating greater freedom in styling.

➣Rather than novelty or trends, personal resonance is prioritized.

Interests & Areas of Engagement

- Top 3 interests – Men:➀Domestic travel ➁Investment / asset management ➂Gourmet dining, cafés, and restaurants

- Top 3 interests – Women:➀Domestic travel ➁Fashion ➂Gourmet dining, cafés, and restaurants

- Possibly due to a stronger saving mindset, overall levels of interest are not expanding significantly.

- Interest in high emotional-value experiences (“koto” consumption) is increasing: Fashion, shopping, movies, travel, and fandom activities (oshi-katsu)—particularly among women—are on the rise, reflecting a desire for mood refreshment and excitement.

- Interest is rising, but spending remains constrained: Among men, there is a notable gap where interest in fashion and shopping is increasing, while actual fashion expenditure is declining.This suggests that interest in fashion has not diminished, but financial constraints and spending discipline are limiting actual purchases.

- 【Communication Trends】

Social Media & Video Platform Usage Trends:Growth in YouTube / Instagram / TikTok

- Among both men and women, usage rates of social media and video platforms are increasing, with the exception of X.

- Men:Growth in YouTube usage is particularly strong.

- Women:Instagram has become firmly established, with over 80% usage. Against the backdrop of hit drama content, Netflix has seen a significant increase.

Information-Seeking Behavior: Growing Influence of Social Media

- Among both genders, the tendency to “search online or on social media immediately when something catches their interest” is increasing.

- A growing dependency is also observed, with more people feeling “somewhat uneasy if they do not check social media.”

- Women demonstrate more active search behavior than men, and social media has become embedded as an information infrastructure.

UGC as a Key Decision-Making Resource

- The influence of UGC (user-generated content)—such as word-of-mouth content and purchaser reviews—is increasing for both men and women. To make careful and error-free decisions, reviewing UGC has become indispensable.

- Men:A strong desire to collect and evaluate trustworthy information in order to make appropriate choices. Reference to reviews and rankings increased by +6.2 points.

- Wome:More than 50% use reviews and rankings as a reference for purchase decisions.

Influential Content Creators: Men: Sports players / athletes, Women: Friends & acquaintances

- Men:Sports players / athletes > friends & acquaintances >celebrities

➣Growth in influence from sports players and athletes is particularly notable, suggesting a “Shohei Ohtani effect.” - Women:Friends & acquaintances > individuals with good fashion sense > musicians

➣Information from “people who feel close and relatable” is especially trusted.

- 【Beauty Trends (Skincare & Makeup)】

Purchase Channels:“Drugstores & Variety Stores” Rank No.1 Across All Age Groups

- Younger consumers prioritize trialability and assortment, while older consumers place greater importance on a trustworthy purchase experience.

- 20s:「Cosmetics select shops and general merchandise / variety stores stand out. The popularity of stores such as @cosme STORE and Loft, where it is easy to try “buzz-worthy cosmetics” and K-beauty, appears to be a contributing factor.

- 30:For skincare, department stores score higher than in other age groups. This may reflect increased trial of higher-priced products driven by changes in skin condition.

- 40s–50:Use of official brand websites increases. Subscription purchases of mail-order / DTC cosmetics are expected to grow.

Information Source:Younger Generations = Social Media + People / Older Generations = In-Store

- 20s–30s:Overwhelming reliance on social media and video platforms (Instagram / YouTube / TikTok). Influence from people—such as beauty YouTubers, influencers, and acquaintances—works in tandem.

- 40s–50s:The importance of in-store information increases with age.

- Internet sources other than social media are used by over 40% across all age groups.

Beauty Attitudes: A Growing Preference for “Smart, Cost-Effective Beauty”

- Against the backdrop of busy lifestyles and rising prices, preferences are shifting toward simple routines and affordable (“petit-price”) beauty.

- At the same time, demand for excitement and emotional uplift from beauty and cosmetics is also increasing. Consumers save where they can, while selectively spending on items that boost their mood—a clear trend toward selective, value-driven spending.

- Skincare focuses on reliability and efficacy: Usage of sunscreen / UV care exceeds 70%, Ingredient-consciousness and desire for samples before purchase remain high across all age groups.

Beauty Attitudes by Age Group

- 20s–30:Highly beauty-positive and quick to respond to new products and trends. Strong desire for self-transformation through cosmetics, beauty treatments, and cosmetic procedures, while still seeking emotional uplift even when mainly purchasing affordable products.

- 40s–50:A combination of minimalist beauty routines and anti-aging focus. Consumers concentrate their spending on necessary and effective care, investing selectively.