The top “person with good fashion sense” was YouTuber/creator “Asaginyo”!

The trend of “watching while doing other activities” has emerged clearly.

The survey was launched in 2021 as a collaboration between Fashion Promotion Course of Fashion Marketing Distribution Department at Bunka Fashion College and Futaba Tsushinsha Co., Ltd. this is the 5th time the survey has been conducted.

Through a survey of students — 74% of the 1,031 respondents were 18 to 21 years old, belonging to the trendsetting “Fashionable Generation Z” — we compiled findings that explore their insights and emerging trends.

Survey overview

- Survey method: WEB survey

- Number of Respondents: 1,013 current students of Bunka Fashion College

- Survey period: June 24 – July 4, 2025

- Survey planning and execution: Futaba Tsushinsha Co., Ltd.

- Cooperation: Bunka Fashion College, Fashion Marketing and Distribution Department, Fashion Promotion Course

Survey content

-

A total of 38 questions covering the following topics:

About Bunka Fashion College’s owned media “prop” / Lifestyle and personal interests / Shopping habits / Desired items and activities / Services and apps considered interesting / SNS and media engagement / Purchasing behavior of fashion items / People perceived as having good taste / Favorite designers, musicians, and artists / Cosmetics purchasing behavior and information sources / Interest in sustainability

Survey result summary

1. Social media platforms used on a regular basis

- The top platforms, used by nearly all respondents, were “Instagram”, “YouTube”, “TikTok”, and “Pinterest”.

“BeReal.” shows signs of its boom settling down, while the demand for “listening while multitasking” has driven growth in the use of music platforms.

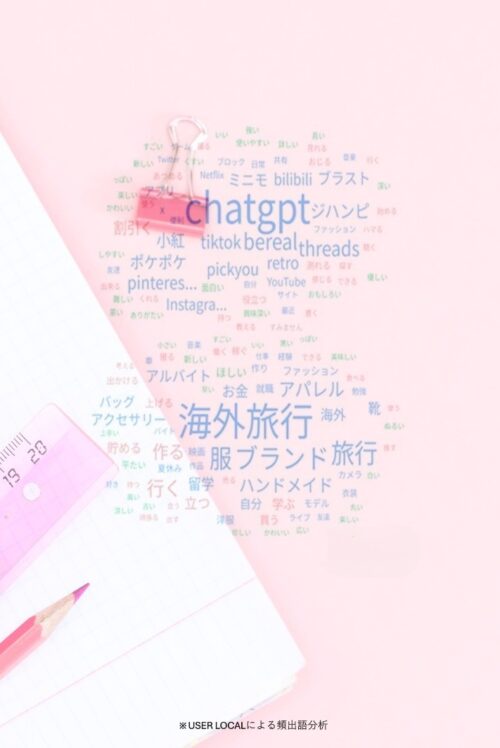

2. Services and apps considered interesting or new

- ChatGPT stood out overwhelmingly.

Respondents also showed interest in “content-sharing services such as social media,” “creative support tools,” “overseas social networking and fashion resale platforms,” and “lifestyle improvement or time-saving services.”

3. Purchased brands & aspirational brands

- Purchases were mainly based on fast fashion, vintage and thrift shops, and affordable e-commerce. Students differentiate between “sweet” girly styles and the “edgy, bold” look of street or mode fashion, while also paying attention to Korean and Chinese brands.

Their “aspirational” choices were luxury houses and innovative designer brands.

4. Online stores used to purchase fashion items

- The two dominant platforms were “ZOZOTOWN” and “SHEIN”.

There are signs of a return to physical stores, along with diversification toward Korean e-commerce sites and fashion resale apps.

5. “People with good taste”

- For the second year in a row, “Asaginyo” ranked No.1.

“Nana Komatsu”, K-pop idols, and fashion YouTubers also ranked highly, reflecting a diversification of preferences.

Please contact our marketing team for a detailed report.